In a rapidly changing world, the benefits of financial literacy cannot be overstated—especially for children. Teaching young minds the essentials of finance equips them with tools they need for a secure future. But why is this education vital?

Opening Inquiry: Why Financial Literacy Matters for Children

With our society gradually shifting towards a more complex financial landscape, the importance of financial literacy for children is paramount. Understanding the value of money, savings, and investments is not just beneficial; it is essential. Financial literacy helps children navigate the challenges of adult responsibilities.

Understanding Financial Literacy

Defining Financial Literacy

Financial literacy refers to the knowledge and skills necessary to make informed and effective decisions regarding financial resources. It encompasses budgeting, saving, investing, and understanding the components of personal finance.

The Importance of Early Education

Introducing financial concepts at a young age can lay a solid foundation for future decision-making. By instilling financial literacy early, children are better prepared to face complex economic realities, which can ultimately lead to long-term financial stability. For more strategies on teaching financial responsibility, explore effective strategies for teaching kids financial responsibility .

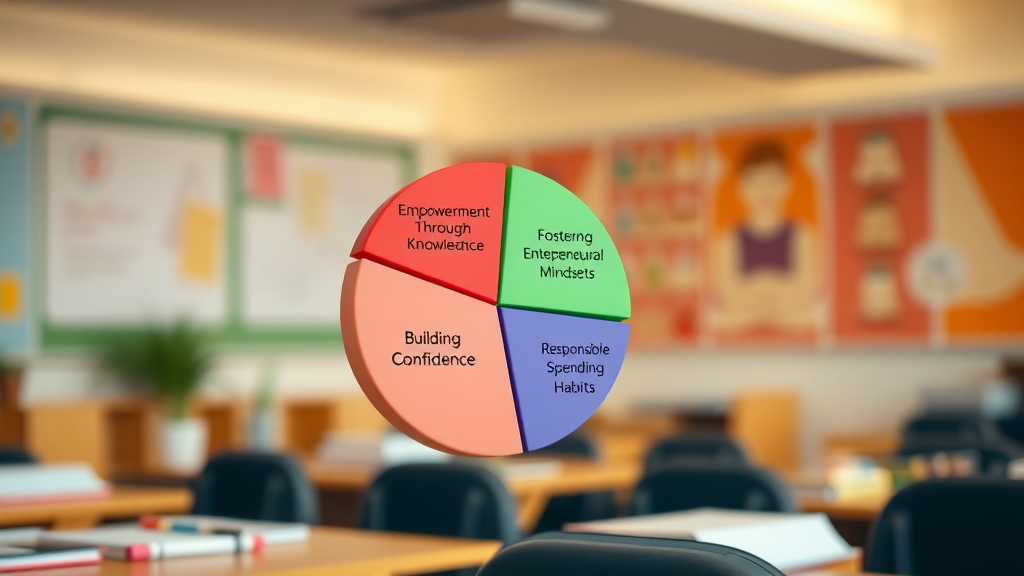

Key Benefits of Financial Literacy for Children

The benefits of financial literacy for children are numerous and impactful, shaping how they view money and finance throughout their lives. Here are some key benefits:

Empowerment Through Knowledge

Empowered with knowledge, children gain confidence in managing their finances. They learn to make thoughtful financial decisions rather than emotional ones. This understanding not only benefits them personally but fosters a sense of responsibility toward their financial future.

Building Confidence in Financial Decision-Making

When children understand how to manage money effectively, they build confidence in their decision-making capabilities. This increased confidence translates into better choices, from smart spending to investment strategies.

Fostering Entrepreneurial Mindsets

Financial literacy fosters an entrepreneurial mindset. Children learn to think creatively about money-making opportunities, encouraging them to innovate and explore new ventures. This foundation is essential for anyone aspiring to run their own business. Discover how AfreximBank is transforming Africa's future by supporting entrepreneurial initiatives.

Promoting Responsible Spending and Saving Habits

By understanding the value of money, children also learn responsible spending and saving habits. These skills are fundamental for financial independence and security, as they encourage kids to think critically about purchases and prioritize saving for future goals.

Expert Insights on Financial Literacy

"Empowering children with financial literacy is crucial for their future success." – Abigael Kabugho, founder of Kidspreneurs Uganda

Practical Strategies for Teaching Financial Literacy

Abigael Kabugho emphasizes practical strategies can be implemented in everyday scenarios. These engage children actively, helping them apply what they’ve learned. Examples include utilizing games focused on budgeting or saving, which make learning enjoyable and relatable.

Common Misconceptions About Financial Literacy

Debunking Myths Surrounding Financial Education

There are misconceptions that financial literacy is overly complex or only necessary for adults. In reality, it can be introduced in age-appropriate ways that resonate with children's experiences.

Understanding the Real Impact of Financial Literacy

Financial literacy sets the groundwork for a lifetime of healthy money management. By debunking myths, we can better advocate for integrating these teachings into children's education.

Actionable Tips for Parents and Educators

Incorporating Financial Literacy into Daily Life

Parents and educators play a pivotal role in fostering financial literacy. Incorporating discussions about money when shopping or handling allowance brings practical learning to life. Create budgets for fun activities or involve children in family financial decisions.

Resources for Teaching Financial Literacy

A wealth of resources exists for those looking to teach financial literacy, from books and apps to structured programs like those offered by Kidspreneurs Uganda. These resources provide fun ways for children to learn and engage with financial concepts.

Conclusion: The Path Forward

Investing in children's financial literacy today can yield tremendous benefits for their future. By empowering kids with essential skills, we prepare them for the challenges of adult life. Understanding the benefits of financial literacy is the first step toward building a financially savvy generation.

FAQs about Financial Literacy for Children

What are the benefits of financial literacy?

The benefits of financial literacy include improved decision-making skills, better financial habits, and the ability to plan for the future.

Which of the following are benefits to financial literacy?

Benefits include empowerment through knowledge, confidence in decision-making, and fostering an entrepreneurial mindset.

What are the pros and cons of financial literacy?

Pros include a better understanding of personal finance, while potential cons can stem from the complexity of certain concepts. However, these can be simplified for child education.

What are the benefits of financial literacy empowering yourself for a secure future?

Financial literacy fosters responsible habits and prepare individuals for financial independence and security in the future.

What You'll Learn

In this article, you'll discover how financial literacy impacts children's development, including its key advantages, strategies for teaching, and common misconceptions.

Key Takeaways on Financial Literacy Benefits

Understanding the benefits of financial literacy for children is crucial for fostering their development and future success. Financial education encourages a generation of informed, responsible financial decision-makers.

Understanding the Role of Financial Literacy in Child Development

It plays a vital role in shaping children's understanding of money and instilling habits that last a lifetime, preparing them for challenges ahead.

Call to Action: Discover Kidspreneurs Uganda Programs For Tomorrow's Business Leaders

Are you ready to empower the next generation? Discover how Kidspreneurs Uganda is making strides in educating children on financial literacy and entrepreneurship. Join us in paving the way for tomorrow's business leaders!

Add Row

Add Row  Add

Add

Write A Comment